Enjoy fast processing, real-time checks, and direct support from Certified Acceptance Agents. Our user-friendly platform makes completing your ITIN and W-7 forms a breeze.

Apply For ITIN NumberCAA AgentsEIN Application

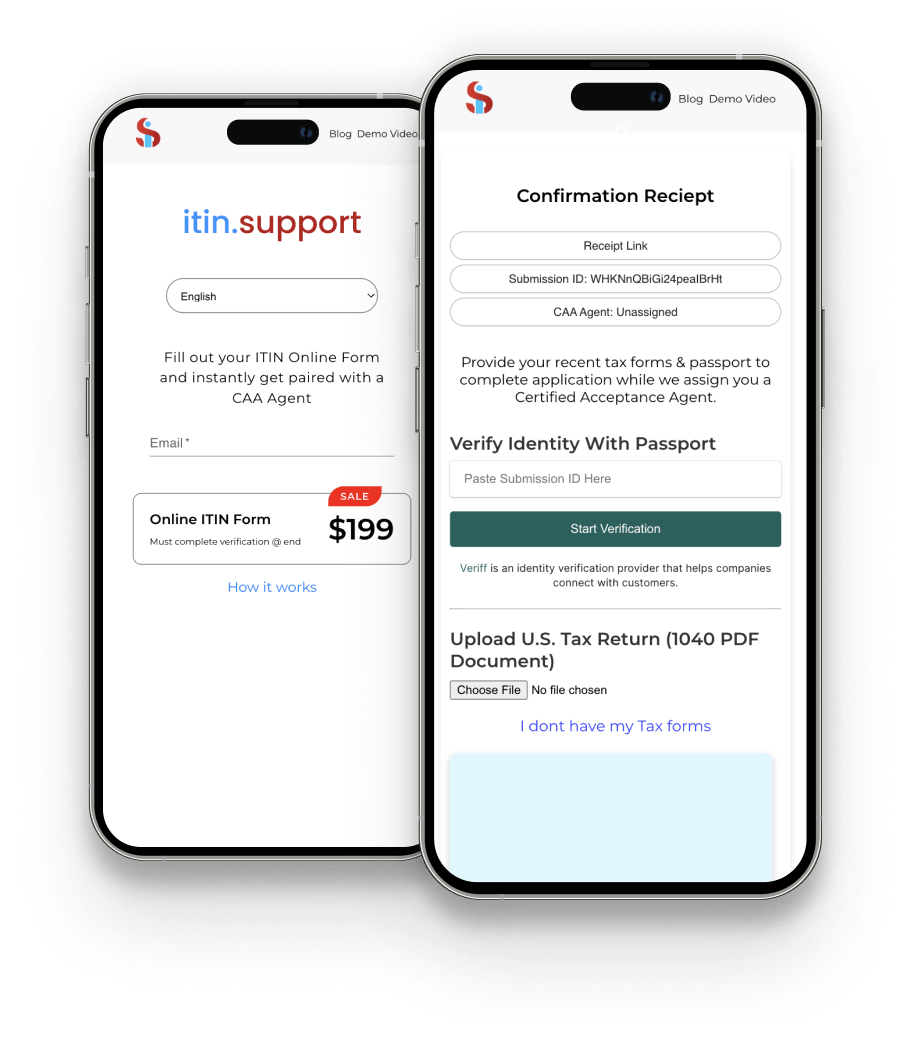

Navigate your ITIN application effortlessly with our user-centric online form. Designed for convenience, our platform demystifies the application process, providing a fast, straightforward path to completion. With our emphasis on accessibility, we ensure that obtaining your ITIN is not only easy but also affordable, catering to all your needs without compromising on quality or speed of service.

CAA Verification: Relax with our Certified Check Service ensuring your ITIN application is accurate and genuine. We work hard to protect your information, meeting top verification standards.

Expedited Shipping: We focus on quick processing of your W7 Form. Our fast shipping ensures your completed W7 form gets to you quickly, wherever you are.

Multilingual Interface: Our multilingual interface lets you fill out your ITIN online form in the language you prefer, making language barriers a thing of the past.

Apply Now

An ITIN, short for Individual Taxpayer Identification Number, is a tax number given by the IRS. It's for people without a Social Security Number who need to file taxes.

The W7 Form, named "Request for IRS Individual Taxpayer Identification Number," is how you start getting your ITIN. It asks for info to check who you are and if you're from another country, setting up your request.

With your W7 Form, attaching a tax return usually proves you need an ITIN for tax filing, helping you get your ITIN without a hitch.

Absolutely, you can initiate the ITIN application process from anywhere in the world. At ITIN Support, we streamline the application process, making it efficient and hassle-free for you, no matter where you are located.

We exclusively accept passports as your form of identification because they serve as a comprehensive document that establishes both your identity and foreign status. This universal recognition expedites the process and removes the possibility of delays that might occur with other types of documents.

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number issued by the IRS to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security Number (SSN). It's needed by those who have tax filing or payment obligations under U.S. law but do not qualify for an SSN, such as non-resident aliens, their spouses, and dependents.

Starting your ITIN application is simple. Visit our website, click on the "Start Application" button, and fill in the required information in the online form. Our user-friendly interface and guidance will help you through the process smoothly.

You'll need to provide a valid passport as proof of identity or two of the following documents: national ID card, driver's license, birth certificate, U.S. visa, or other documents as specified by the IRS. Our platform will guide you on how to securely upload these documents for verification.

Our Certified Acceptance Agents (CAAs) will review your submitted documents for accuracy and completeness. They ensure that your application meets all the IRS requirements, minimizing the risk of rejection due to errors or omissions.

itin.support team mails the completed information to the IRS within 48 hours after payment. From there, it can take 6-10 weeks to receive your ITIN number via mail.

In the unlikely event of a rejection, our team will review the IRS's feedback with you, address any issues, and assist you in resubmitting your application at no additional cost.

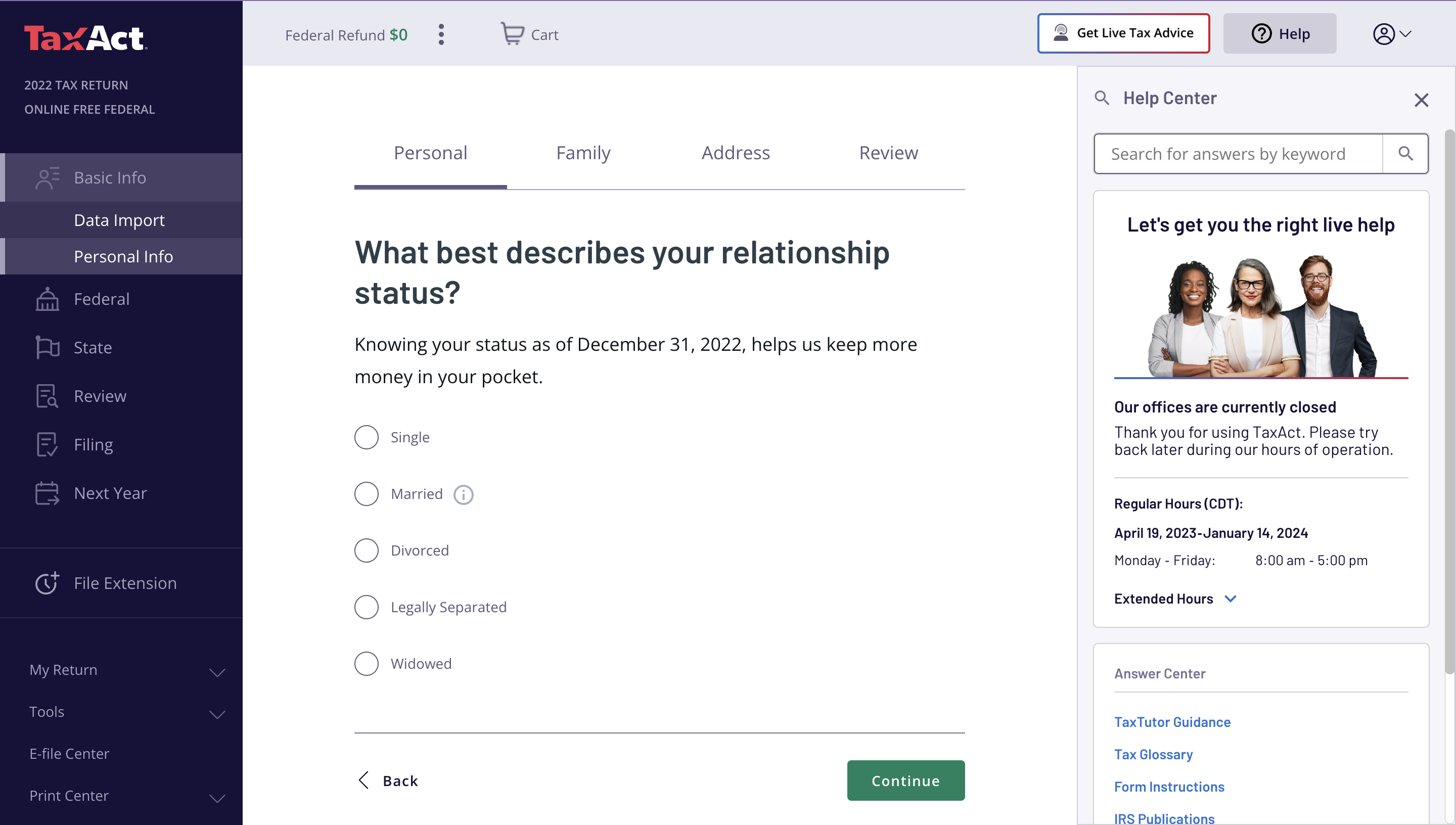

In order to be approved for an ITIN, you must also submit your tax forms jointly. You can get your taxes done using our partnership portal with JBK Tax or using TurboTax for a more affordable option.

Absolutely, your document security is our top priority at ITIN Support. We employ state-of-the-art encryption technologies to safeguard your sensitive information. Only authorized personnel have access to your documents, ensuring a secure and confidential process for your ITIN application.

Your passport is the cornerstone of the ITIN application process. It is the only document that can singly establish both your identity and foreign status. By using passports, ITIN Support streamlines the application process, eliminating the need for multiple documents and thereby reducing the potential for delays and errors.

No, at ITIN Support we exclusively accept passports for ITIN applications. This is to streamline the process and to avoid the potential delays and complications that may arise when using other forms of identification. Your passport singularly provides comprehensive proof of both your identity and foreign status, making the ITIN application process straightforward and efficient.

After your ITIN number has been successfully issued, all physical copies of your personal documentation are securely destroyed to maintain your confidentiality and security. Electronic records are kept encrypted and secure, adhering to data protection regulations and best practices.

Only Certifying Acceptance Agents (CAAs) have access to your submitted documents. Our CAAs are authorized professionals who undergo thorough training and background checks. They are the only ones who can handle and certify your personal documentation during the ITIN application process.

Itin.support offers the best affordable price starting at $189.

We include premium shipping in our pricing so that once your documents are mailed to the IRS you will receive a tracking number via email.

Free Option: After selecting the link, you will be taken to TaxAct, which is sponsored by the IRS. It provides both a free option and the ability to save the completed tax form as a PDF file.

In this video, you will see a team member quickly bypass the personal questions and demonstrate how to obtain that PDF from the site. Once you finish the questions and collect your PDF, you will be able to finish our form in 2 minutes.

Tax Agent: If you prefer a tax specialist to assist you, we have several agencies we partnered with who can complete the form for you, but for an addition cost ranging from $199 - $249.

Yes, obtaining a loan with an ITIN (Individual Taxpayer Identification Number) is possible. Many financial institutions recognize an ITIN as a valid ID for loan applications. However, it's essential to note that the success of your loan application will also depend on other factors such as your credit score and employment status. If you're new to the country and don't have a credit history, some lenders may require additional documentation or a co-signer. With your ITIN, you can start building a U.S. credit history, making it easier to secure loans in the future.

An ITIN (Individual Taxpayer Identification Number) serves multiple purposes but is primarily used for tax reporting. Here's a rundown of what an ITIN can do for you:

Tax Reporting: It allows you to file federal taxes, even if you don’t have a Social Security Number.

Employment: While an ITIN doesn't grant work authorization, it does allow you to receive income from U.S. sources and subsequently report it.

Financial Services: An ITIN helps you open a U.S. bank account and apply for credit cards.

Building Credit History: With an ITIN, you can start building a credit history in the United States.

Identification: Some institutions accept an ITIN as a form of ID, making it easier for you to carry out various transactions, such as getting a loan or renting an apartment.

By providing you with an ITIN, ITIN Support enables you to access these various financial services and fulfill your tax obligations in the U.S. effectively.

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS) for individuals who are not eligible for a Social Security Number (SSN). Designed for tax reporting purposes, an ITIN helps you fulfill your U.S. tax obligations and is a key identification number that allows you to file tax returns. While it doesn't grant the right to work in the U.S., it is essential for non-U.S. residents, including undocumented immigrants, and foreign nationals who have tax reporting requirements under U.S. law. If you're looking for a streamlined and secure ITIN application process, our platform at ITIN Support is designed to guide you through every step.

If you're a student in the U.S. but are not eligible for a Social Security Number (SSN), then you'll likely need an ITIN for tax-related activities such as claiming tuition and education tax credits or for receiving taxable scholarships, fellowships, or grants. Even if you're a non-resident international student who may not be required to file a tax return, you might still need an ITIN for other tax documentation requirements. Keep in mind that an ITIN is only intended for tax reporting purposes and does not authorize you to work in the United States. To know more about how you can obtain an ITIN quickly and hassle-free, visit our ITIN application page.